Key Features of Private Retirement Schemes (PRS)

- Home

- /

- Learning zone

- /

- Learn about Capital Market...

- /

- Key Features of Private...

Private Retirement Scheme (PRS) Frequently Asked Questions

Have you ever thought about retirement? Regardless of which stage you are currently at in your career, retirement is something you cannot avoid thinking about. Whether you are on the verge of retirement or many years away from it, do you think you have enough or will have accumulated enough savings for retirement? Does your retirement fund only consist of your monthly Employees Provident Fund (EPF) contributions? Do you wish your retirement fund went beyond just your EPF?If yes, you may want to consider investing in a Private Retirement Scheme (PRS). The PRS was launched in July 2012 by Prime Minister Yang Amat Berhormat Dato Sri’ Najib Tun Abdul Razak, with the objective of offering Malaysian employees and the self-employed an additional avenue to save for their retirement. It also offers an opportunity for employers to make additional voluntary contributions towards the retirement savings of their employees. In this article, we will discuss the key features of the PRS. After reading this article, you will be able to identify the key features of the PRS and gain a better understanding of it, enabling you to make an informed PRS investment decision.

Key Features of PRS:

- PRS are schemes where the accumulated benefits to members are determined by the amount contributed plus investment returns thereon.

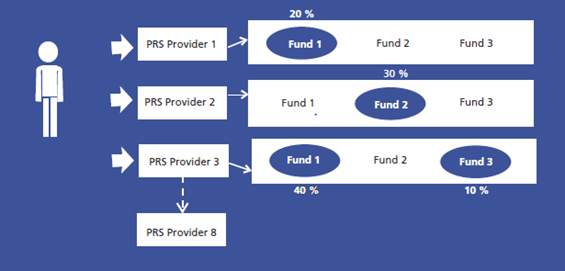

- Members have the option to contribute to more than one fund under a PRS or to contribute to more than one PRS, offered by different PRS Providers.

- There are no fixed amounts or fixed intervals for making contributions to PRS, it is entirely up to the investor and on a voluntary basis.

- A default option will be made available for members who select their PRS Provider but do not specify a fund option. It is the responsibility of the PRS Provider to switch their members to default funds in accordance with the relevant age group.

| Growth Fund | Moderate Fund | Conservative Fund | |

| Age Group | Below 40 years of age | 40-50 years of age | Above 50 years of age |

| Parameters |

Maximum 70% equities

Investment outside Malaysia is permitted |

Maximum 60% equities

Investment outside Malaysia is permitted |

80% in debentures/fixed income instruments of which 20% must be in money market instruments and a maximum of 20% in equity

Investment outside Malaysia is not permitted |

Individuals:

Members choose PRS Providers and funds according to their risk appetite and investment profile

or

Default option for members who select their PRS Provider but do not specify a fund option

Employers:

Employer may channel contributions to a particular PRS Provider, with employees choosing the type of funds offered by that Provider

or

Employer may channel contributions to a particular PRS Provider, and where employees do not make a fund selection, contributions can be channeled to default option of that PRS provider

-

- Members would also have the option to switch funds within a PRS at any time,or change to another PRS Provider once a year, subject to terms imposed by the PRS Provider. The first transfer can only be requested by a member one year after making the first contribution to any fund under the Scheme.

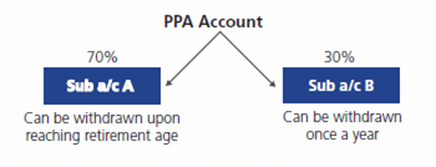

- All contributions made to PRS will be split and maintained in sub-accounts

A and B as follows:

The value of sub-account A and B can increase or decrease according to the unit price. The unit price is the worth of each unit held by a member from day to day. Units are priced daily.

- In order to provide efficiency and convenience for members, a single PPA is established to keep track of their PRS contributions as well as to maintain records of all PRS related transactions made by members. The PPA will not manage funds internally or accept contributions but will facilitate instructions from members.

- Individual investors will have just one account for better management of retirement savings as information from various sources can be consolidated within one account.

- The diagram below shows an example of an individual channelling contributions to several funds under a PRS offered by different PRS Providers.

- Tax incentives are provided to both employers and individuals for the first 10 years from assessment year 2012; in addition to the tax deduction permitted for EPF contributions:

- Individuals – tax relief of up to RM3,000; and

- Employers – tax deduction on contributions to PRS made on behalf of their employees above the statutory rate of up to 19% of employees’ remuneration for a period of 10 years.

- A tax exemption is also provided on income received by the funds under theSchemes.

- The regulatory framework set out under the Capital Markets & Services Act 2007 (CMSA), which includes the PRS Regulations, PRS Guidelines and PRS Eligibility Requirements for PRS Providers, provide for high standards of regulation and conduct.

- Under the PRS Guidelines, PRS Providers must provide cost effective voluntary retirement schemes and ensure that Schemes are operated in a proper and efficient manner. The funds are segregated via a trust structure so that members’ assets are protected under the controls of an independent trustee company.

- PRS Providers, Trustees and the Administrator must by law act in the best interests of members.

- Prudential investment limits for funds within the Scheme are provided for under the PRS Guidelines. The investment policies of the funds under the Scheme must be consistent with the objective of building savings for retirement and ensure that there is a prudent spread of risk.

- The disclosure framework ensures transparent and frequent information to members by requiring clear, concise and effective disclosures to be made to investors so that investors are fully informed of the investment strategy, the risks associated with the Scheme and all relevant fees and charges involved.

- Action will be taken if there are any false or misleading statements to investors.

- Reminder:

- Unit prices and distribution payable, if any, may go down as well as up.

- As with all investments, the returns from contributions made to PRS are not guaranteed and will depend on the performance of the PRS funds.