Exchange Traded Funds

- Home

- /

- Investment Options

- /

- Exchange Traded Funds

WHAT IS ETF?

Generally, exchange-traded funds (ETFs) are index-tracking funds that are listed and traded on a stock exchange like stocks.

What are the key features of an ETF?

In general, an ETF has the following features:

- Index tracking

An ETF is designed to track performance of an index (e.g. KLCI, bond index, etc.) - Exchange trading

An ETF is structured as a unit trust while it is also tradable on the stock market, i.e Bursa Malaysia like stocks, during the usual trading hours. Investors can buy or sell ETFs through their licensed stockbrokers anytime during trading hours - Fees and charges

There are two types of fees and charges, i.e the fund management fees (management fees and other administrative costs) and trading costs. The fund management fees are usually deducted from an ETF’s assets, and its net asset value (NAV) will be affected accordingly. Trading ETFs on Bursa Malaysia will also incur transaction costs, such as brokerage fees, stamp duty, etc. - Net asset value and trading price

Each ETF has a NAV that is calculated with reference to the market value of the securities held. However, the trading of ETFs on the Bursa Malaysia, like that of a stock, is determined by the demand and supply of the market. Investors must bear in mind that the trading price of an ETF may not be equal to its NAV. - Dividend entitlement

An ETF may or may not distribute dividends, depending on its dividend policy. - Regulated fund

Like any other authorised funds, an ETF has to comply with the relevant regulatory requirements imposed by the SC. Investors must note that the SC’s authorisation does not imply its endorsement of any particular product.

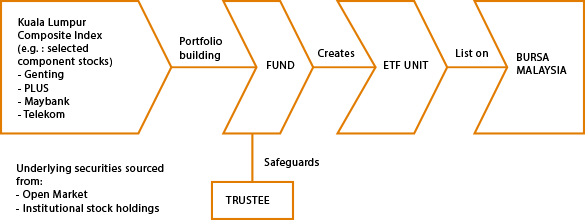

HOW AN ETF UNIT IS CREATED?

Investor’s Guide to Exchange-traded Funds

RISKS

LOW COST

An ETF is traded in board lots which are usually maintained at an affordable level. It also offers a wide array of securities for a minimum investment.

DIVERSIFICATION

By investing in an ETF, you can replicate the gains and losses of the basket of securities it is designed to track without incurring the expense of buying all the underlying securities yourself.

LIQUIDITY

An ETF is continuously traded on the exchange during trading hours.

TRANSPARENCY

The underlying index and constituent securities of an ETF are transparent, and price quotations are disseminated during trading hours. In addition, trading information of an ETF is easily accessible on a real-time basis.

BENEFITS

Risks vs benefits

Before you invest in an ETF, read the prospectus and pay close attention to the following:

Information about the index that the ETF is tracking (e.g: KLCI, bond index, etc.)

- The ETF’s investment objective and strategy

- The fees, charges and trading costs borne by the investor

- The ETF’s dividend policy

- Information on the management company

- The channels through which trading information of the ETF will be made available or disclosed.

After reading the prospectus and other relevant materials, and considering your investment objectives, risk appetite and the amount of funds available, you can then decide whether the ETF is suitable for your investment needs.

Reference: http://www.bursamalaysia.com/