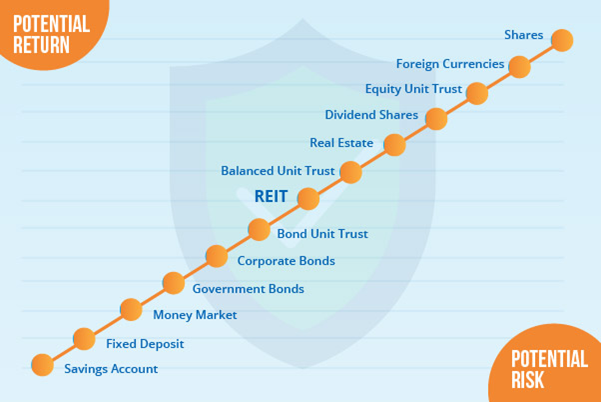

When it comes to successful investing, the smart investor will only consider potential returns after first considering the risks involved. There are many levels of risk. In the lowest spectrum of risk, products such as fixed deposits may give you guaranteed potential low returns, while products such as Futures and Options usually sit at the far end of the spectrum – highly risky, but with the potential of offering higher returns.

The above diagram represents a simplistic view of several common investment products and their risks. In this article however, we are going to take a closer look at the inherent risks involved in unit trust funds:

Lower risk

Money market funds

Money market funds offer lower risk, and also lower returns as these funds invest in low risk money market instruments. However, they do carry the risk of being affected by interest rate changes.

WHO?

This Money Market Fund would be best suited for those who are looking to grow their emergency fund without risking their principal. These funds are also very liquid, making it easier to withdraw the money when there is an emergency.

Fixed income funds

Slightly higher up the risk chart are fixed income funds. These funds are usually made up of government securities, corporate bonds, and money market instruments.

Like its name suggests, an income fund aims to provide investors with regular income payments, but with less emphasis on capital growth. Fixed income funds can also help diversify an investment portfolio.

WHO?

This is a good tool for those who need regular income, such as retirees or those who need some help in boosting their passive income. It’s ideal if you’re looking for a little more returns and are willing to accept less security on your funds as well since they are more susceptible to market movements than the more secure money market funds.

Moderate Risk

Balanced funds

In balanced fund investments, investors are exposed to stocks, but with the risk being mitigated because a portion of the fund will be allocated to debt securities like bonds.

The objective of a balanced fund is to achieve the perfect balance of safety, income and capital appreciation by adopting a general strategy of investing in fixed income and equities. It is typically done by allocating 60% of the investment into equities, with the balance of about 40% remaining in fixed income.

WHO?

Balanced funds are recommended for first-time equity investors as they would get a taste of investing in stocks while still mitigating their risks. It’s also a great opportunity for investors who have always been very conservative to explore slightly riskier investments with potentially higher returns.

High Risk

Global/International equity funds

Equity funds are generally considered high risk but global or international equity funds mitigate some of this risk because they dive into different markets, which can help mitigate country-specific risks. The main difference between the two? A global fund invests in different countries including your home country, while international funds only invest in other countries.

WHO?

Investors who wish to delve into equity or other high risk investments, but wish to avoid specific market risks. These funds offer some great options for tapping into countries with potential for rapid growth. However, try to use these with other investments in other markets in order to benefit from its country risk mitigation aspects.

Equity funds

In theory, equity funds can generate higher returns compared to lower risk investments like fixed income funds, such as government bonds and cash.

However, equity funds are considered riskier or more volatile as they invest almost entirely in an equity market. There are different types of equity funds with different levels of risk, but equity funds should always be seen as risky investments.

WHO?

If you are an investor seeking aggressive capital appreciation and have a high risk tolerance, equity funds should be right up your alley. Interestingly, although high in risk, equity funds should still be in most investment portfolios but with allocations adjusted according to risk profiles. These would be ideal funds for those who want to have growth in their portfolios but have also taken steps to mitigate the risks accordingly.

Conclusion

When creating your portfolio, always determine the percentages to be allocated to stocks and bonds, which should reflect your tolerance for risk and ability to handle major market downturns. Your portfolio should also include all types of stocks, whether large or small, growth or value, domestic or international, dividend- or non-dividend payers as well as lower risk bonds.

Remember, always choose to allocate more assets in lower risk funds, and less on high risk funds. This will help create a well-balanced portfolio and reduce overall investment risk.

Happy investing!

© Securities Commission Malaysia (SC). Considerable care has been taken to ensure that the information contained here is accurate at the date of publication. However no representation or warranty, express or implied, is made to its accuracy or completeness. The SC therefore accepts no liability for any loss arising, whether direct or indirect, caused by the use of any part of the information provided. The information provided is for educational purposes only and should not be regarded as an offer or a solicitation of an offer for investment or used as a substitute for legal or other professional advice. For enquiries regarding sharing, republishing or redistributing this content please write to: [email protected].