Recently, Tom bumped into Jerry (his college mate) while strolling in a shopping mall. They decided to have coffee together. Here is how their conversation went.

Tom began with, ‘Hey bro, what brings you here?’

Jerry replied, ‘Annual General Meeting (AGM), bro. I was attending the investor’s AGM for ABC Bhd. It was held at the convention centre just now.’

Tom nodded and said, ‘Wow. I didn’t know that you are into shares. How long have you been ‘playing’ shares?’

Jerry smiled. With glee, he replied, ‘Well Tom, I have been a shareholder of ABC Bhd for the last 3 years. It’s a long-term investment. Personally, I’m not one of those who ‘plays’ shares. After all, those who play shares are often not the type of people that would attend AGMs.’

Tom asked, ‘So, how’s it is performing?’

Jerry replied, ‘Well, it’s pretty decent so far. In addition to capital gains, I have been collecting some duit kopi (dividends) on a quarterly basis for the past 3 years.

Tom asked, ‘Wow, that’s great. Honestly speaking, I’ve been thinking about investing in the stock market. However, I’ve often hesitated as I think stock investing is risky. Since you’ve been in the markets for quite some time, how do you reduce risks from your stock investments?’

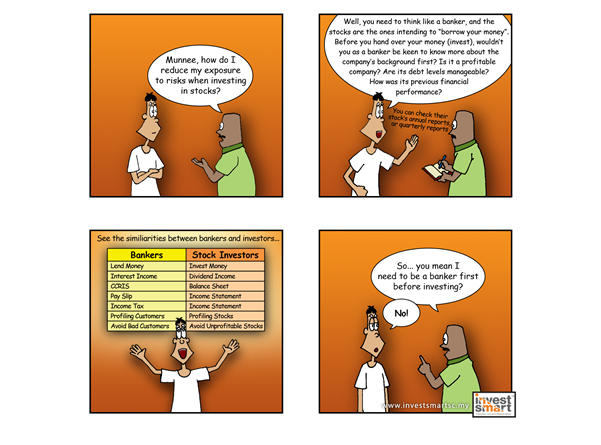

Jerry replied, ‘It’s simple. Just think like a banker when you invest in stocks.’

Tom exclaimed, ‘What do you mean, Jerry?’

Jerry explained, ‘For a start, banks derive interest income from lending money to people. However, banks do carry the risk of lending. This is because not all borrowers will fulfill their loan obligations. So, banks practise risk management policies to filter customers who can service their loan from bad customers who couldn’t. You can apply the same principles in stock investing.’

Curious, Tom responded, ‘Really? I didn’t know that. How does it work?’

Jerry continued, ‘Tom, do you have mortgage payments?’

Tom answered, ‘Yes, I have one for my own residence.’

Jerry said, ‘When you applied for a mortgage, did the loan officer ask for your particulars?’

Tom answered, ‘Yes. They wanted a lot of documents. I gave them my photocopied IC, bank statement, EPF* statement, pay slip, CCRIS* score and income tax statements’.

Jerry explained, ‘Do you know why your banker needs your IC?’

Tom answered, ‘Is it because they want to know who I am first before lending money to me?’

Jerry nodded. Then, he continued with, ‘How about your pay slip and income tax statement?’

Tom answered, ‘I think the banks want to know where I am working, how I made my money, and whether I am servicing other loans before lending money to me. But Jerry, where is this heading? How does it relate to stock investing?’

Jerry answered, ‘Everything. In a way, investors are like bankers. Stocks are like customers who intend to borrow money. Before investing, an investor would ask for a stock’s annual reports, quarterly reports and investors’ presentations. This is because, an investor wants to know:

- What business or sector is the company involved in?

- Who are the customers?

- How much profit is it making?

- What is the current debt level of the company?

- What is it going to do to make in the future.

Taking out a pen and a piece of paper, Jerry drew the following diagram:

| No. | Bankers | Stock Investors |

| 1 | Lend Money | Invest Money |

| 2 | Interest Income | Dividend Income |

| 3 | CCRIS | Balance Sheet |

| 4 | Pay Slip | Income Statement |

| 5 | Income Tax | Income Statement |

| 6 | Profiling Customers | Profiling Stocks |

| 7 | Avoid Bad Customers | Avoid Unprofitable Stocks |

Jerry continued, ‘From this, investors are able to separate stocks that are financially solid from mediocre stocks that are not. As a result, investors would reduce their risk of making bad investments as they avoid investing in stocks that display continuously poor financial results.

Impressed, Tom commented, ‘Wow! This is amazing. I’ve never viewed stock investing in this manner.’

‘But Jerry, I have another problem. You know I’m not good with maths. I don’t know how to read financial reports. Where do you think I can start learning about stock investing?’

Jerry replied, ‘I’m glad that you asked. Did you know that InvestSmart, an investor empowerment initiative by the Securities Commission Malaysia (SC) organises stock market and unit trust seminars for retail investors?’

Jerry continued, ‘The seminars aim to encourage members of the public to take control over their finances so that they can be responsible for their own future and wealth, equip investors with the knowledge, skills and tools needed to exercise good judgement and discretion in making investment decisions and encourage more informed retail participation in the capital market. To find out more, you may log on to ‘www.investsmartsc.my’

*EPF: Employees Provident Fund

**CCRIS: Central Credit Reference Information System