Clone Firm Scams

Clone firms scams are becoming increasingly rampant in Malaysia. Clone firms refer to individuals or organizations impersonating legitimate investment firms licensed by the Securities Commission Malaysia (SC). The scam uses names and logos that closely resemble those of legitimate firms.

How Do Clone Firms Scams Operate?

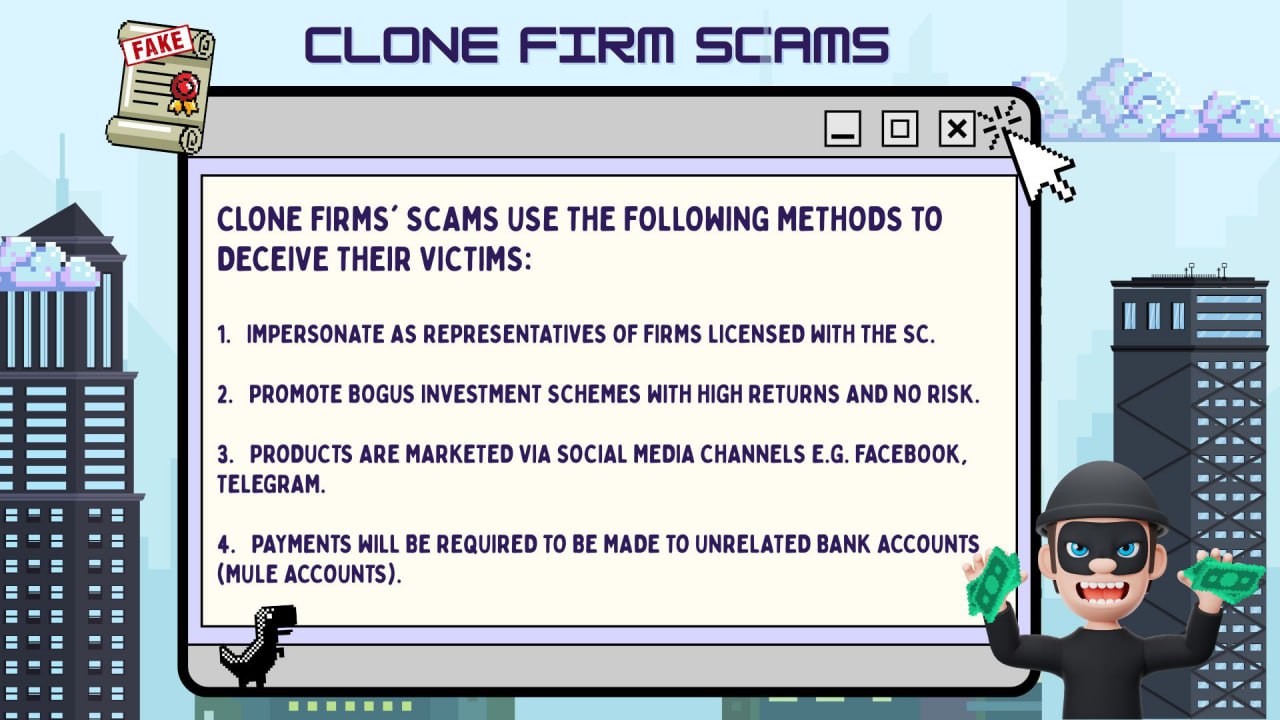

Clone firms’ scams use the following methods to deceive their victims:

- Impersonate as representatives of firms licensed with the SC.

- Promote bogus investment schemes with high returns and no risk.

- Products are marketed via social media channels e.g. Facebook, Telegram.

- Payments will be required to be made to unrelated bank accounts (mule accounts).

Example of Clone Firm scams

Ahmad, a private sector employee, was attracted by an investment offer on social media. It promised returns of RM10,000 within 3-6 hours with an investment of RM250. Ahmad saw that the name and logo used in the investment package marketing materials was that of a licensed firm by the SC. There were also fake letters and certificates using the SC’s name and logo, seemingly confirming the investment opportunity as legitimate and recognized by the SC. Without further verification, Ahmad paid to a bank account belonging to an individual account unrelated to the investment firm. After a while, Ahmad realized he could not withdraw any of the supposed “profits”. He then realized that he had fallen victim to scam.

5 steps to avoid Clone Firm Scams:

- Be cautious of investments offered via social media platforms.

- Never deposit money into the bank accounts of individuals or unrelated entities.

- Only deal with authorized companies or individuals and make payments to their official bank accounts.

- Verify an individual or entity is authorized through SC’s “Investment Checker” at https://www.sc.com.my/investment-checker.

- If in doubt, check with the SC via email [email protected] or call at 03-6204 8999