HERE’S HOW TO EVALUATE YOUR UNIT TRUST FUND’S PERFORMANCE

Hold or sell? Buy or wait? These are important investment decisions for every investor.

However, one thing is certain – investors should not base their decisions on emotions, or worse, rumours, but on the fund’s performance over time. Therefore, the funds must be regularly evaluated.

Unit trust investments, like any other investment, do not guarantee returns. This means that your principal value can fluctuate according to changes in the market. As such, it is imperative that you examine the performance of your funds regularly.

Fund evaluation is a good barometer of a fund’s performance over the years and how well it is managed. It allows you to chart the progress of your funds, and should be done regularly.

Here are three ways you can evaluate the performance of your unit trust funds:

1. Calculate the total returns

A unit trust fund’s performance can firstly be measured by its total returns. A fund’s total returns represent the change in the value of an investment in the fund. Total returns can be identified in two ways – cumulative total returns and average annual total returns.

Cumulative total returns take into account the rise or fall in the fund’s unit price, while assuming that the income and capital gains distribution are reinvested into the fund. On the other hand, average annual total returns refer to compounded total returns, which are measured on an annual basis. Total returns, compounded over time, can really magnify.

When evaluating a fund’s performance, one of the best approaches is to compare the total returns of similar or correlated funds over the same period. For example, an equity fund would be best compared with another equity fund that invests in companies of a similar business nature. A bond fund would be compared to other funds with a similar maturity period or credit rating.

However, it is important to ensure that the fees and charges are deducted from the total returns for a more accurate figure. This figure only addresses the fund’s total returns against its peers in a specific period, without considering its unique individual risk.

So, where can you find this information? It is usually available in a fund’s annual prospectus or semi-annual report.

Sample page from a unit trust fund’s prospectus

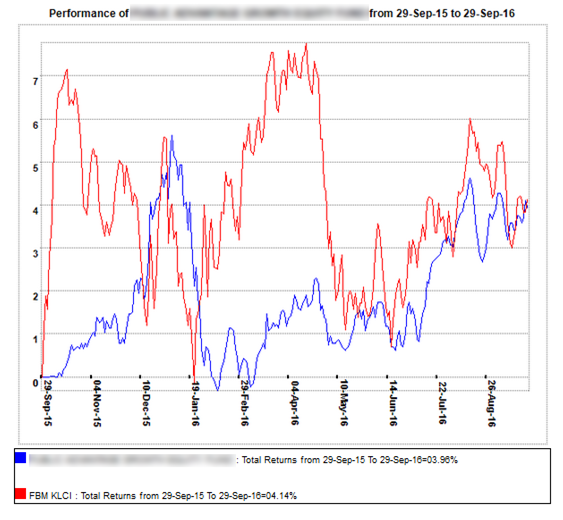

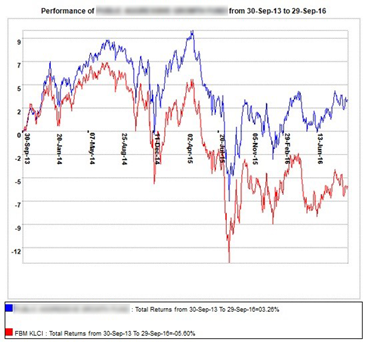

2. Compare a fund’s performance against its benchmark index

Another way to evaluate a fund’s performance is to measure it against a benchmark index. Unit trust funds investing in Malaysian equities typically evaluate their progress by benchmarking it against the FBM KLCI Index.

A fund is considered to have outperformed its benchmark index if the fund’s returns are higher than its benchmark.

As benchmark indices are well-established and commonly used to represent current market conditions, comparisons with it are widely accepted as a fund evaluation method. Comparing your fund’s performance against its benchmark will also show you the value-add brought by your fund managers.

Lookout!

For this fund evaluation method, you need to compare the performance of your unit trust fund against related peer funds. Reason being, although your funds may perform well against the corresponding benchmarks, they also tend to outperform other related funds.

Sample page from a unit trust fund’s prospectus

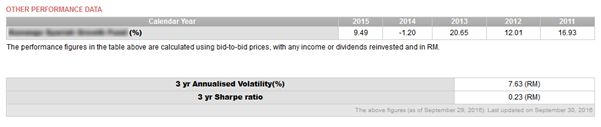

3. Consider performance relative to risk taken

One way to measure this is by looking at the Sharpe ratio – also known as the reward-to-volatility (risk) ratio – which measures a fund’s historical risk-adjusted performance. The higher a fund’s Sharpe ratio, the better the returns generated per unit of risk taken. In other words, when you compare two funds of a similar nature, the fund with the higher Sharpe ratio would have generated more returns for the equal amount of risk exposure. A higher Sharpe ratio also indicates consistency in returns generated.

As it is complicated to calculate the Sharpe ratio of a fund using the mathematical formula, you may want to refer to your unit trust agent or unit trust fund performance rankings that are available online or in print.

Sample page from an online unit trust distribution website

Conclusion: Be an informed investor

Unit trust fund rankings or ratings, and other methods of evaluating a fund’s performance only enable you to compare the performance of your unit trust fund with other funds. Unfortunately, many investors often misinterpret these evaluations as recommendations, when they are not.

Before you invest in a fund, it is imperative that you equip yourself with the necessary information and knowledge to make informed decisions. Request for the fund’s prospectus from your unit trust agent (or obtain it online), and read it thoroughly to understand the fund’s goals, risk factors and performance records.

Always keep in mind that a fund’s past performance is not a reliable indication of its future performance; a more accurate indicator would be its long-term track record. Reason being, in the long term, financial markets and economies globally will go through various cycles. Investors should therefore consider how different unit trust funds perform over various time frames to gain a better understanding of how funds react under different market conditions.

Although fund evaluation methods provide insight into a fund’s performance and can assist investors with their investment decisions, it is not failsafe. You will still need to do your due diligence on the funds in which you are considering to invest. You also need to match your investment goals with the fund’s ability to perform within a stipulated time frame, and the level of risk you are willing to take on.

Image from Financial Planning for Canadians

© Securities Commission Malaysia (SC). Considerable care has been taken to ensure that the information contained here is accurate at the date of publication. However no representation or warranty, express or implied, is made to its accuracy or completeness. The SC therefore accepts no liability for any loss arising, whether direct or indirect, caused by the use of any part of the information provided. The information provided is for educational purposes only and should not be regarded as an offer or a solicitation of an offer for investment or used as a substitute for legal or other professional advice. For enquiries regarding sharing, republishing or redistributing this content please write to: [email protected].